Domestic Reverse Charge – After Brexit

What happens now?

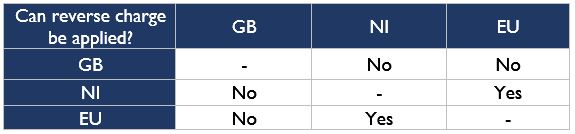

After Brexit, transactions between VAT-registered businesses between the UK and EU countries will be treated as foreign transactions and reverse charge will not apply. Previously, the reverse charge was applied to all products and certain services between UK and EU businesses.

Transactions between Northern Ireland and the EU are an exception to this change and are still subject to reverse charge. For any transaction between Northern Ireland and the countries of GB, the reverse charge procedure will not apply.

Customs Handling

After the end of the transition period (1st January 2021), the import and export of goods from and to the EU will be subjected to customs and will be similar to trading with non-EU countries.

The Free Trade Agreement between the UK and EU signed on 24th December 2020 will secure a tariff and quota-free trade, however, the traders must comply with the ‘Rules of Origin’ to prevent any tariff evasion.

Exporting Goods & VAT

Since the UK is no longer part of the EU VAT regime and customs union, the new ‘Border Operating Model’ has been introduced to handle imports and exports of goods between the UK and EU, excluding Northern Ireland. The UK exporters will require a UK EORI (Economic Operator Registration Identification) from HMRC. UK VAT registered businesses which had traded internationally in the past would’ve already received their new EORI number from the HMRC. This number must be used in all export paperwork to help the customs authorities identify the exporter.

Export sales are usually exempt from UK VAT however the exporter will require all the necessary paperwork to prove the goods have left the UK, including sales invoices, customs declarations, transport documents etc.

Importing Goods & VAT

UK importers now face a new procedure on how the UK import VAT will be handled. This needs to be planned accordingly, to avoid any unrecoverable VAT. The businesses may choose whether they will complete their own import process or let a customs intermediary handle this for them. In order to qualify for the ‘Rules of Origin’ to be entitled to the tariff-free Trade Agreement established on 24th December 2020.

VAT registered businesses can opt to use the ‘Postponed VAT accounting’, thus allowing them to account for import VAT on their VAT return, rather than paying it immediately for imported goods, which burdens their cash flow. This means they should fill out the VAT return boxes as below:

Box 1 (VAT due on sales and other outputs): include VAT due on imports accounted for, through postponed VAT accounting

Box 4 (VAT reclaimed on purchases and other inputs): include VAT reclaimed on imports accounted for, through postponed VAT accounting

Box 7 (Total value of purchases and other inputs excluding any VAT): include the total net value of imports, excluding any VAT.

To use postponed VAT accounting, the below requirements need to be met:

- The goods imported are for business use only

- A GB or XI EORI number has been provided in the customs declaration

- Your VAT registration number has been provided in the customs declaration

- The customs declaration states that you will be postponing the VAT (box 47e)

Businesses who opt not to use postponed VAT accounting and pay the VAT due immediately when the goods enter free circulation will be required to fill in boxes 4 and 7 only.

Supplying services

According to HMRC, if you’re supplying services that are treated as supplies from the UK to consumers outside the UK, your services are supplied where your customer belongs and so are outside the scope of UK VAT and the normal place of supply of services rules apply.

Tax representatives in the EU

For many EU countries, your VAT number will no longer suffice and it will be necessary to appoint a tax representative who is established in the country of supply.