Late submission of VAT returns

The deadline for your VAT return is generally 1 month and 7 days after the end of a VAT reporting period. Completing a VAT return approx. every 3 months will determine how much VAT is due. This lets HMRC know the figures of your total sales and purchases in the period, and therefore the amount of VAT you owe, can reclaim, and the amount of any VAT refund from HMRC.

The online VAT return submission deadline and paying HMRC are usually the same: 1 calendar month and 7 days after the end of an accounting period. The deadlines are different if, for example, you use the VAT Annual Accounting Scheme.

Completing the VAT tax return and VAT payment can also be made either by setting up a direct debit with HMRC (this means that HMRC will take any payment due from your nominated bank account on or shortly after the 10th of the month. If HMRC doesn’t deduct the payment, then it is not your fault for late payment), or online through the HMRC portal.

If you haven’t missed the due date before, you will probably have a bit of elbow room on submitting a late VAT return. Instead of an immediate fine, you’re likely just to receive a warning that you need to prioritise being timely with your tax responsibilities. You’ll receive a VAT return reminder letter, explaining that your VAT is now late, and you’re required to quickly bring your account up to date.

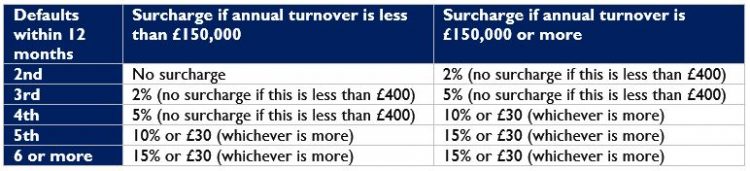

The surcharges (penalties) are calculated based on a percentage of the VAT outstanding on the due date of the relevant VAT period and they are calculated based on the table below.

There are a few exceptions (there will be no surcharge for a late VAT return) if:

- You have paid all your VAT by the due date

- There is no VAT to pay / you are due a VAT repayment

HMRC can charge you a penalty of up to:

- 100% of any tax under-stated or over-claimed if you send a return that contains a careless or deliberate inaccuracy

- 30% of an assessment if HMRC sends you one that’s too low and you do not tell them it’s wrong within 30 days

- £400 if you submit a paper VAT return unless HMRC has told you you’re exempt from submitting your return using your VAT online account or Making Tax Digital compatible software.

For more detailed information visit the HMRC website: https://www.gov.uk/vat-returns/surcharges-and-penalties