Can Tax Agents help with deferred VAT?

No interest or penalties have been charged on that outstanding VAT debt, and businesses have been free to pay the amount due at any time. This grace period is coming to an end, as HMRC had indicated that businesses will be required to pay the VAT debt in full by 31 March 2021, join the new VAT deferral payment scheme (pay off the amounts due in equal instalments) or contact HMRC if you need extra help in paying.

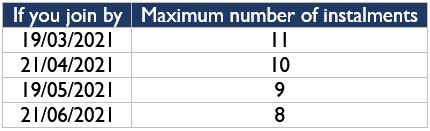

Where taxpayers opt into the VAT deferral new payment scheme instead of paying the full amount by the end of March 2021, they can make up to 11 smaller monthly instalments (depending on when they join) which are interest-free. All instalments of the outstanding amount must be paid by the end of March 2022. The VAT deferral new payment scheme will be open from 23rd February up to and including 21st June 2021. If you do not join the deferral scheme, any outstanding VAT debt will accrue a 2.6% interest from 1st April 2021 and HMRC may impose late payment penalties or opt for debt collection against the business.

As part of the new scheme’s payment plan, the business needs a direct debit set up to make regular instalment payments through their business account, so the business owner or company director will need to access the portal themselves. As tax agents aren’t authorised to make payments directly out of clients’ bank accounts, they won’t be able to enter this agreement on their clients’ behalf. On the bright side, HMRC will allow businesses to still have Time to Pay arrangement for other outstanding HMRC debts and tax, and still join in the deferral scheme.

To be eligible for the scheme you need to:

- Join the scheme yourself, your tax agent can’t do it for you

- still have deferred VAT to pay

- have your VAT returns up to date

- opt-in by 21st June 2021

- pay the first instalment when you join the scheme

- Pay the instalments through Direct Debit

*If you cannot pay by DD but still want to join the scheme, contact an HMRC adviser through the COVID-19 helpline.

HMRC has published these prerequisites before taxpayers can opt-in for the scheme

- creating your own Government Gateway account if you do not already have one

- submitting any outstanding VAT returns from the last 4 years. You will not be able to join the scheme if you have not done so

- correcting errors on their VAT returns as soon as possible. Corrections received after 31 December 2020 may not show in their deferred VAT balance

- ensuring you know how much you owe, including the amount originally deferred and how much you may have already paid.

Depending on the month you decide to join the scheme, the HMRC will determine the maximum number of instalments that are available for you. See the below table for more details: